39+ Income driven repayment plan calculator

If youd like to lower your federal student loan payments consider applying for an income-driven repayment IDR plan. Assuming annual income growth of 35 your final monthly payment would be After making payments for years you will have paid a total of and would receive in forgiveness compared to your current plan.

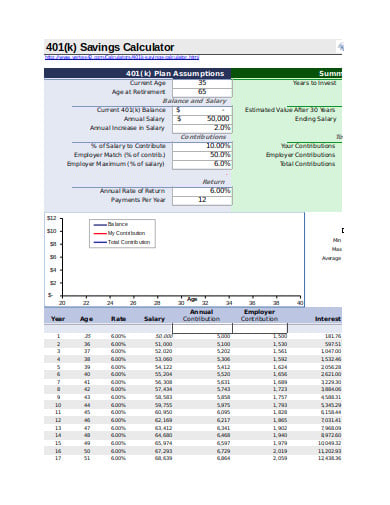

6 401k Calculator Templates In Xls Free Premium Templates

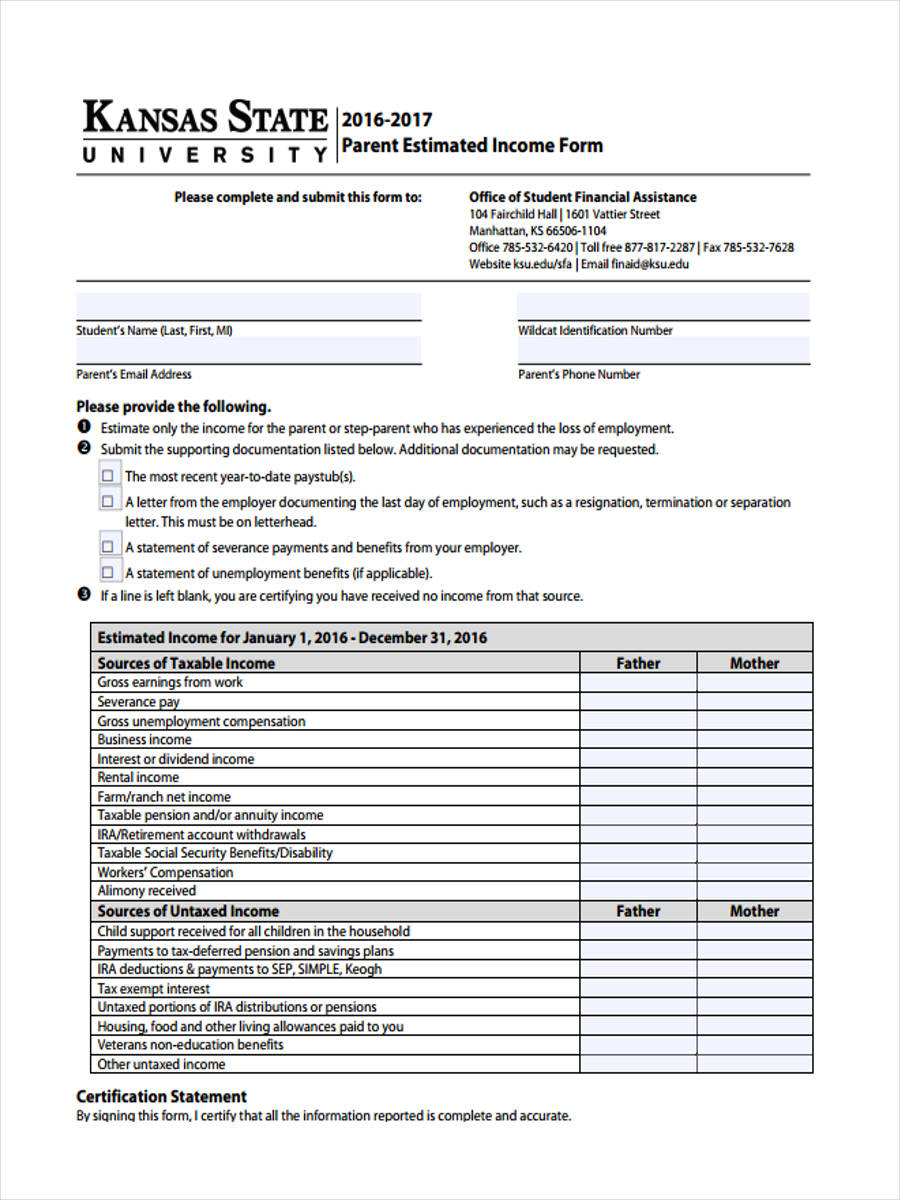

Biden plans to place borrowers with annual incomes above 25000 on an income-driven repayment plan that caps monthly student loan payments at 5 of.

. Percent of Amount Sales sales 142000 100 Wildhorse Company has four operating divisions. College graduates get better jobs at higher pay along with flexible hours remote work and student debt repayment as employers face worker shortages. 739 299 - 993 299 - 993 Get My Rate View Details on LendKeys website.

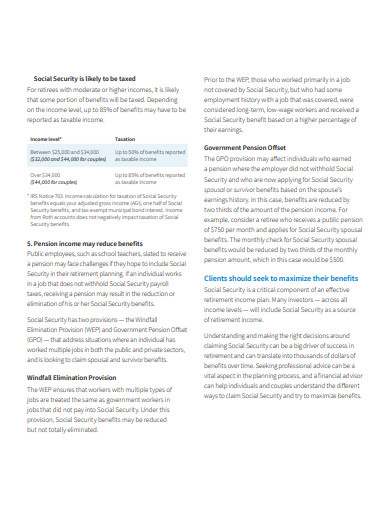

It is primarily funded through a dedicated payroll taxDuring 2015 total benefits of 897 billion were paid out versus 920. Unfortunately income-driven repayment doesnt take that into consideration but it is an option Student Debt Relief offers a calculator to help determine your discretionary income. Rates range from 375-935 375 916 APR.

You may find that refinancing your car loan is an easy way to lower your monthly repayment. The companys most recent monthly contribution format income statement follows. The gov means its official.

The advantage of income-driven plans is. The federal government offers four different income-driven repayment plans for student loans. Your monthly payment on PAYE would be a difference of from what you are currently paying.

This Public Service Loan Forgiveness Calculator shows which income-driven repayment plan is best to maximize student loan forgiveness for student loans. But its actually a specific federal program for certain types of borrowers. This publication has information on business income expenses and tax credits that may help you as a small business owner file your income tax return.

Before sharing sensitive information make sure youre on a federal government site. IBR stands for Income-Based Repayment Sometimes people talk about IBR casually to mean all types of income-driven repayment plans. For those who earn a minimum income of 60000 annually or 100000 for the household the World Mastercard adds free Boingo Wi-Fi access car rental and mobile device insurance and Mastercard.

Federal government websites often end in gov or mil. Many students use a 529 plan to pay for their college but some expenses arent qualified and cant be covered by it so plan ahead for these costs. If you qualify your.

That calculator gives you a yearly estimate for different makes and models by taking 5 factors into consideration alongside depreciation to give you an idea of. 39 state attorney general offices reached a settlement with student loan giant Navient this wek. For the non-cumulative scheme the interest on FD is paid on a monthlyquarterlyannual basis based on the monthlyquarterlyannual income plan opted by you.

Income-based repayment sets your payments at 10 to 15 of your monthly discretionary income and allows you to stretch repayment out for 20 or 25 years. The current Student Loan Repayment Plan system run by the federal student loan system is a confusing cluster of options that many graduates and former students cant easily navigate. 20000 km driven yearly.

IBR has been around since 2007 when President George W. 35-year old female driver living in Toronto Ontario. This 10 yearpublic service loan forgiveness calculator assumes a 3 annual income growth.

This article concerns proposals to change the Social Security system in the United StatesSocial Security is a social insurance program officially called Old-age Survivors and Disability Insurance OASDI in reference to its three components. Student Loan Repayment Calculator. Bush signed a big overhaul of federal financial aid practices.

They limit monthly payments to a percentage of the students discretionary income generally 10. During the first quarter of 2022 the company reported aggregate income from operations of 214000 and the following divisional results. Borrowers must have had at least one federal student loan that was eligible for income-driven.

For the cumulative scheme the interest is compounded to the deposit amount on an annual basis on March 31st every year and the accumulated interest will be paid on maturity along with. Â Â Â Divis. 2021The American Rescue Plan Act of 2021 the ARP adds new sections 3131 3132 and 3133 to the Internal Revenue Code to provide credits for qualified sick and family leave wages similar.

Careers Biden appoints 1st Native American as. Apply for an Income-Driven Repayment IDR Plan. If your income increases over time your payments may increase.

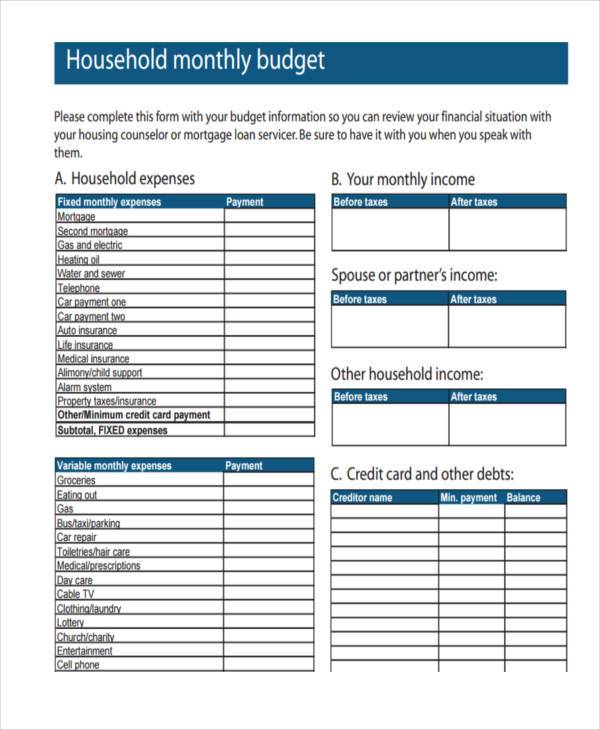

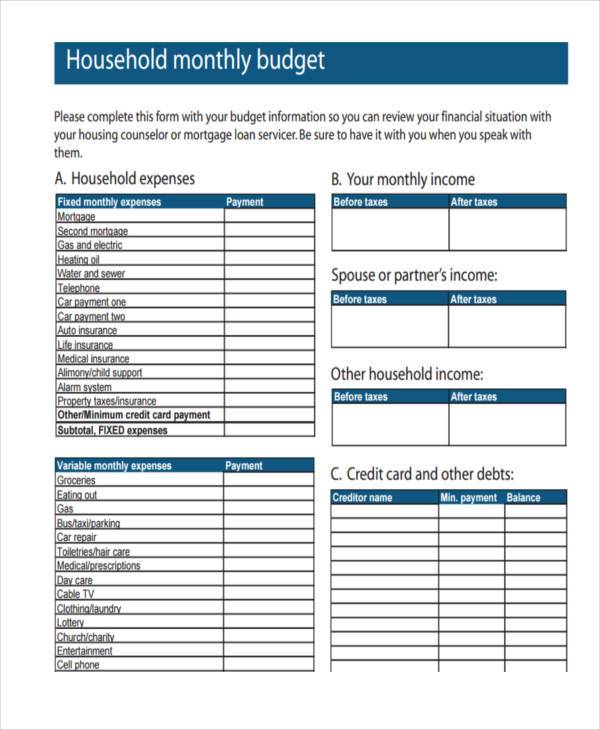

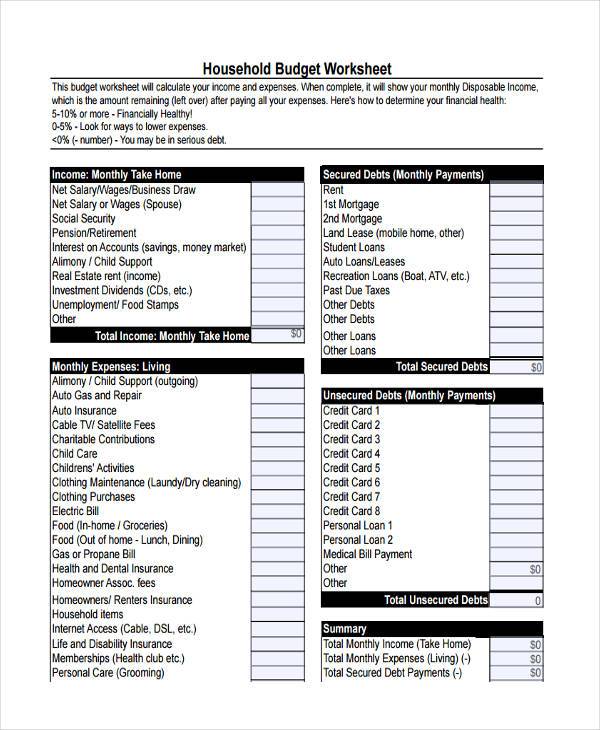

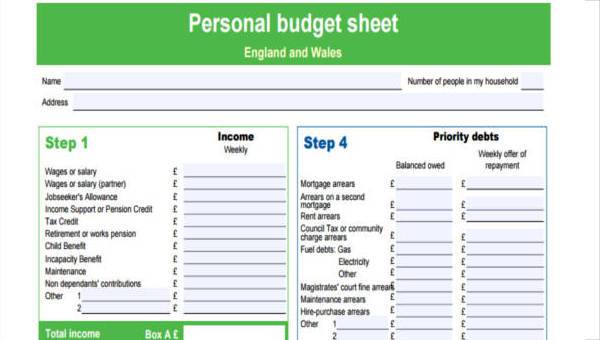

Free 39 Sample Budget Forms In Pdf Excel Ms Word

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Pin On Get Yo Shit Together

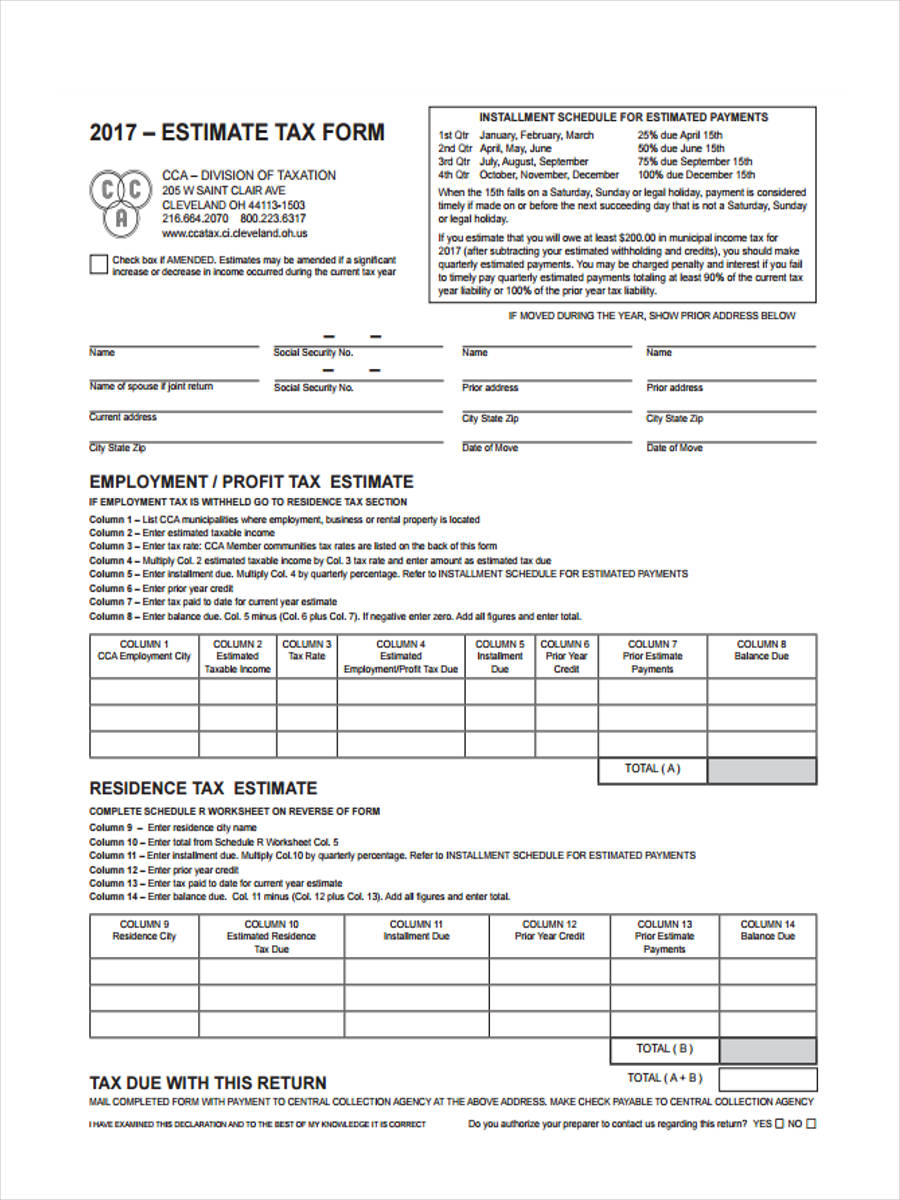

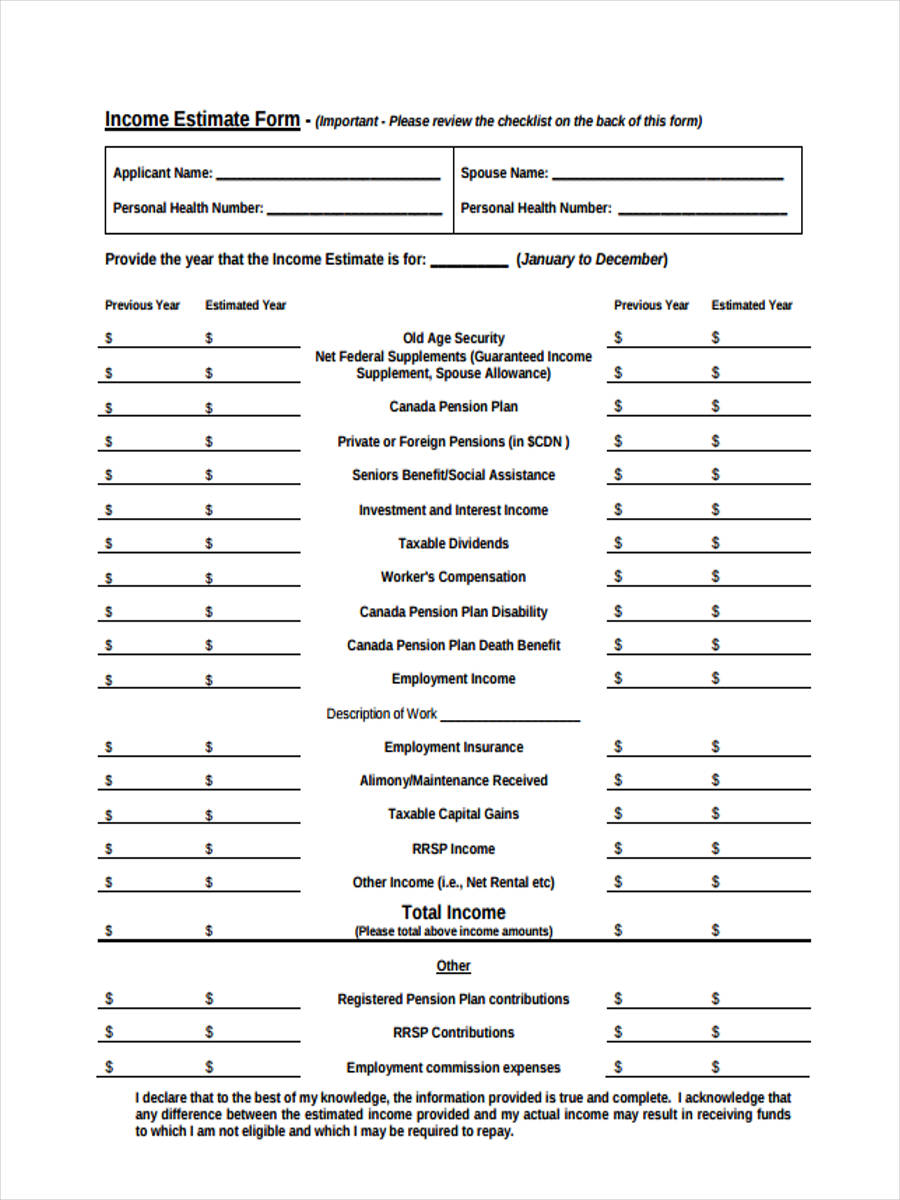

Free 39 Estimate Forms In Pdf Ms Word

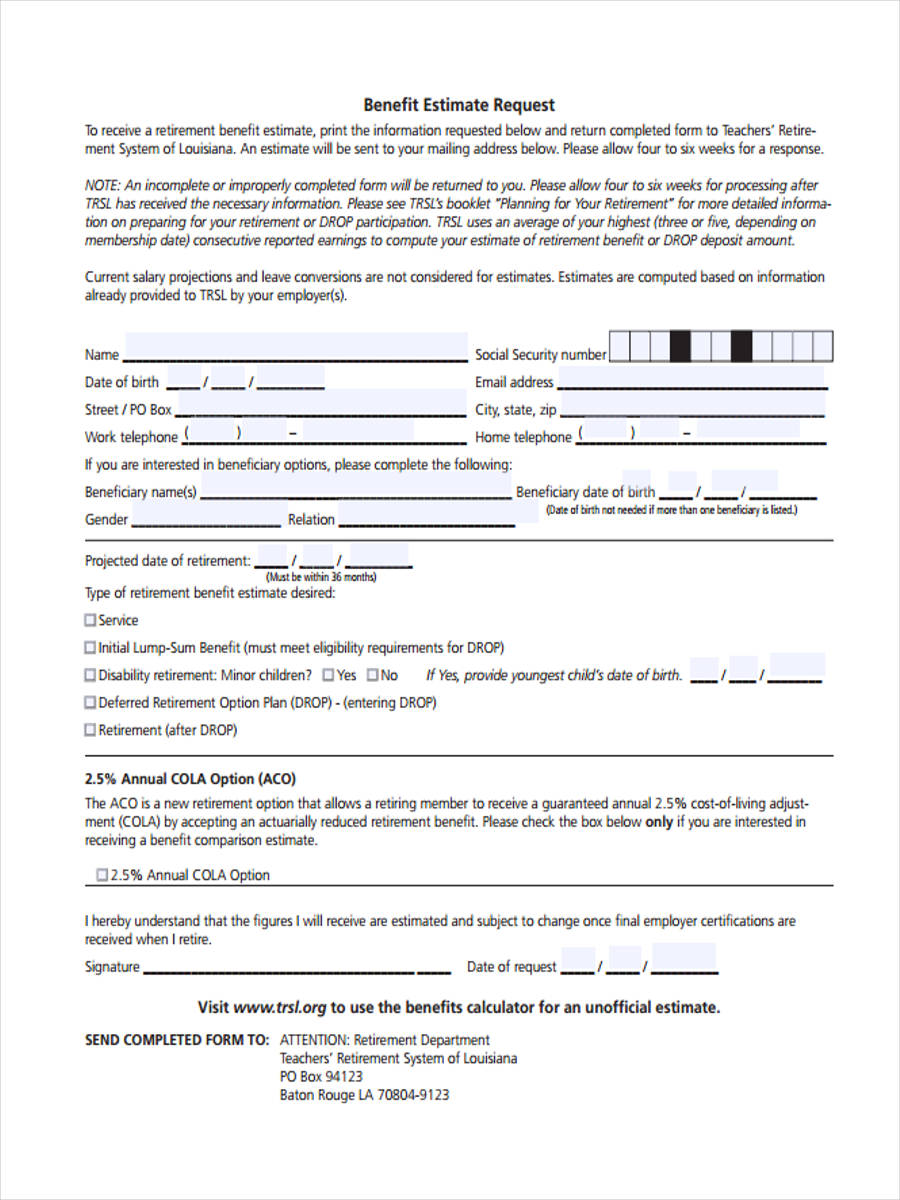

9 Retirement Calculator Templates In Pdf Doc Free Premium Templates

Free 39 Estimate Forms In Pdf Ms Word

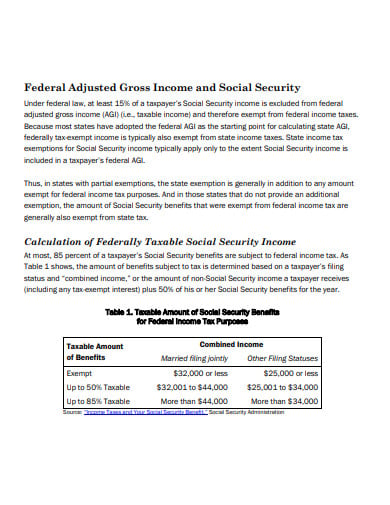

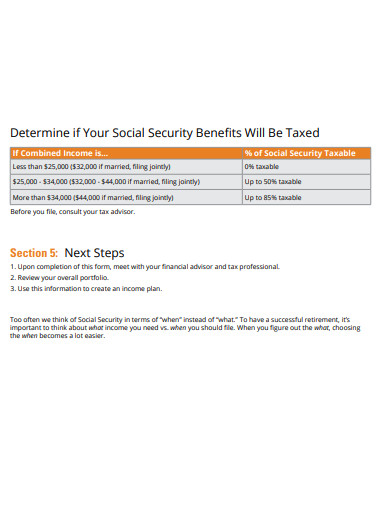

11 Social Security Income Calculator Templates In Pdf Free Premium Templates

9 Retirement Calculator Templates In Pdf Doc Free Premium Templates

Free 39 Estimate Forms In Pdf Ms Word

11 Social Security Income Calculator Templates In Pdf Free Premium Templates

Free 39 Sample Budget Forms In Pdf Excel Ms Word

Free 39 Sample Budget Forms In Pdf Excel Ms Word

107 Ways To Pay Off Your Student Loans Student Loan Planner

11 Social Security Income Calculator Templates In Pdf Free Premium Templates

Free 39 Estimate Forms In Pdf Ms Word

Pin On Budget

11 Social Security Income Calculator Templates In Pdf Free Premium Templates